In a groundbreaking scientific achievement, Colossal Biosciences announced Tuesday the successful birth of three dire wolves, marking the first-ever de-extinction of an animal species previously lost to time.

The dire wolf, extinct for over 12,500 years, was a large North American canid often associated with the fictional creatures from HBO’s “Game of Thrones.” According to Colossal, the rebirth represents a critical milestone in their de-extinction technologies and pathway toward reviving other extinct species.

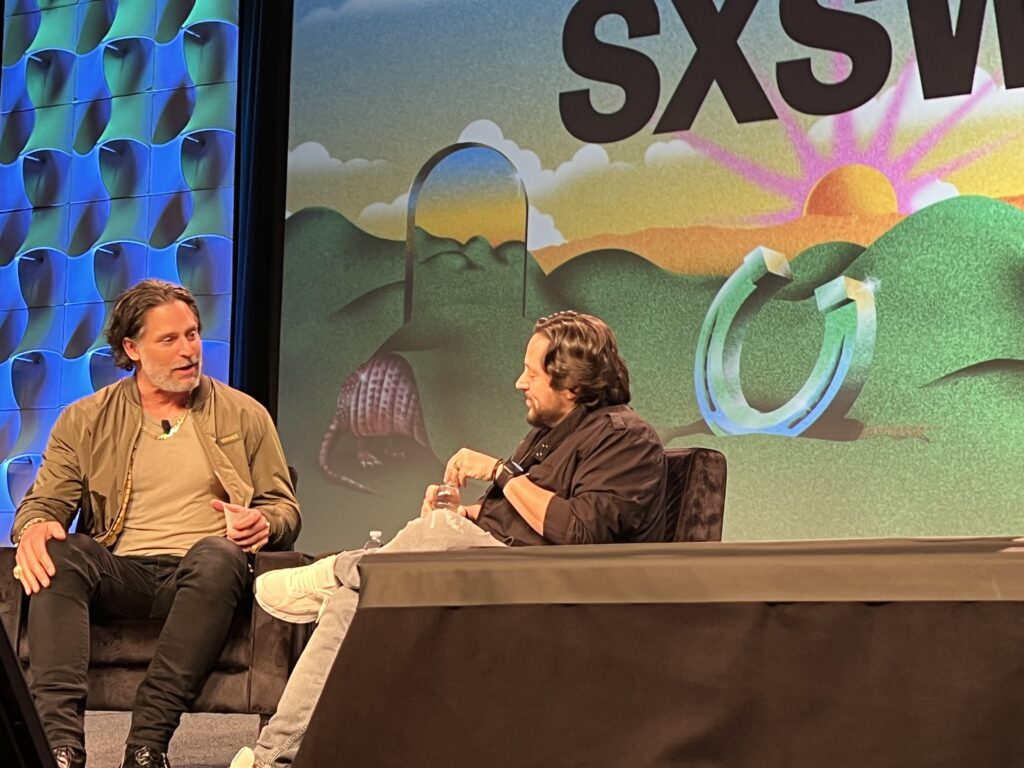

“Our team took DNA from a 13,000-year-old tooth and a 72,000-year-old skull and made healthy dire wolf puppies,” said Colossal CEO Ben Lamm. “It was once said, ‘any sufficiently advanced technology is indistinguishable from magic.'”

The company’s achievement extends beyond the dire wolf, with scientists also successfully birthing two litters of cloned red wolves—North America’s most critically endangered wolf species—using a novel blood cloning approach.

The three dire wolf pups include two adolescent males named Romulus and Remus, and one female named Khaleesi. The red wolf litters consist of one adolescent female named Hope and three male puppies: Blaze, Cinder and Ash.

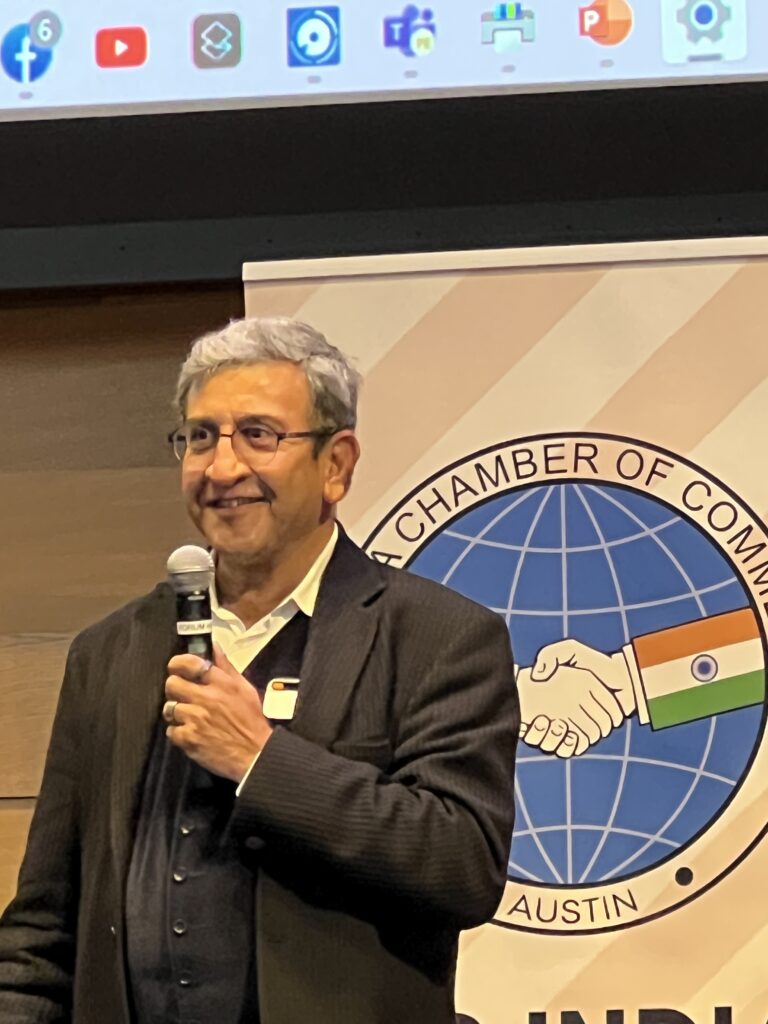

Harvard geneticist and Colossal co-founder Dr. George Church noted that the dire wolf project involved “the largest number of precise genomic edits in a healthy vertebrate so far,” with 20 unique precision germline edits, including 15 from ancient gene variants.

The wolves currently reside on a 2,000-acre ecological preserve certified by the American Humane Society and registered with the USDA. The facility features specialized engagement zones, redundant security measures and continuous monitoring to ensure animal welfare.

“The de-extinction of the dire wolf is more than a biological revival. Its birth symbolizes a reawakening – a return of an ancient spirit to the world,” said MHA Nation Tribal Chairman Mark Fox, highlighting the cultural significance of the achievement.

To accomplish the de-extinction, scientists extracted and sequenced ancient DNA from two dire wolf fossils, assembled ancient genomes, identified gene variants specific to dire wolves and performed multiplex gene editing to a donor genome from the gray wolf, the dire wolf’s closest living relative.

The company’s analysis revealed dire wolves had white coat color and thick fur, adaptations consistent with ice age conditions. Their research also showed gray wolves share 99.5% of their DNA with dire wolves.

Dr. Beth Shapiro, Colossal’s Chief Science Officer, said their approach “sets a new standard for paleogenome reconstruction” and established “the genomic foundation for de-extinction.”

The technology developed for the dire wolf project has immediate conservation applications, as demonstrated by the birth of two litters of red wolves. With fewer than 20 red wolves remaining in North America, Colossal’s red wolves could increase the number of founding lineages in the captive breeding population by 25%.

“Colossal is drastically changing the prognosis for countless endangered species around the world,” said Aurelia Skipwith, former Director of the U.S. Fish and Wildlife Service.

The company plans to eventually restore both species in secure ecological preserves, potentially on indigenous land.