In 2005, Jay Hallberg, founder, and chairman of Spiceworks met with three friends in Austin to create what has become Spiceworks.

They wanted a place where IT professionals could connect and talk about technology. That free platform evolved into a sophisticated social network for IT professionals.

Recently, Ziff Davis acquired Spiceworks. The company just held its annual SpiceWorld convention at the Austin Convention Center with more than 2,500 Spiceworks members, which they dub “Spiceheads” from all over the world. At the event, Hallberg sat down with Ideas to Invoices to talk about the evolution of the company and plans for future growth.

Over the years several companies have inquired about buying Spiceworks, Hallberg said. He took Ziff Davis’ offer to the board and they decided it was the best fit, he said.

Ziff Davis, a division of J2 Global, was a competitor to Spiceworks, Hallberg said. Ziff Davis has a long history of producing great content and that combines well with Spiceworks’ community and products, Hallberg said.

“After a good 14 year run as an independent privately held company, it just felt like it was the right time and right partner to take the next step and write the next chapter in our story,” Hallberg said.

Under Ziff Davis, Spiceworks is going to remain in Austin and Hallberg will continue to run it. The company did lay off 59 people in Austin on August 14th, shortly after announcing the acquisition. Hallberg said he can’t comment on how many employees the company has now in Austin now that it is part of Ziff Davis, but he did say he doesn’t expect any more layoffs locally.

Now that it has joined with Ziff Davis, Spiceworks is more of a global operation with an office in Austin, Hallberg said. It also has offices in Costa Rica, London, and Hyderabad, India, he said.

Twelve years ago, Spiceworks held the first annual SpiceWorld conference at the old Alamo Drafthouse Theater on South Lamar. They rented a movie theater for the day and about 100 people attended the conference. They had lunch in the alleyway. Five vendors attended the event.

“In some ways, it has changed incredibly,” Hallberg said. “In some ways, it has stayed the same.”

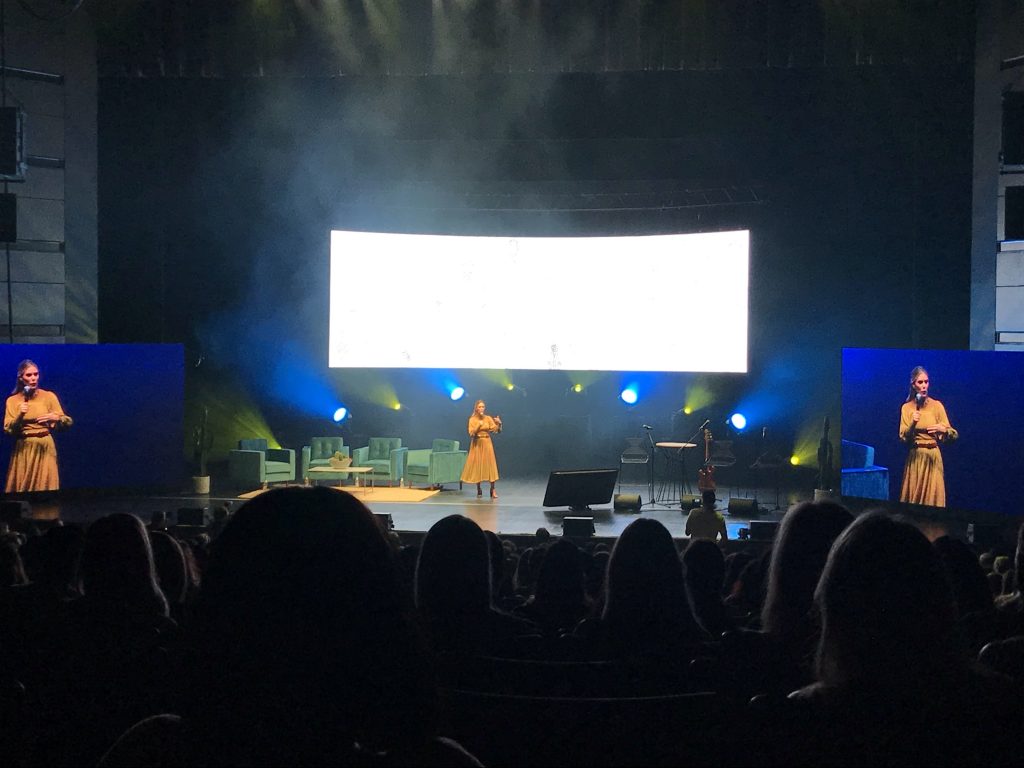

Spiceworks quickly outgrew the Alamo Drafthouse, Hallberg said. SpiceWorld has been in the Austin Convention Center for the last five years, he said.

“It’s this two-day celebration of everything that is IT,” he said.

Spiceworks’ community is everything to the business, Hallberg said.

Spiceworks sees millions of IT professionals every month, he said. The community has tens of thousands of people who are highly active in that community. Spiceworks rewards them with badges on a pepper scale with pure capsaicin being the highest honor. It honors those members with awards at the convention every year.

At SpiceWorld 2019, Spiceworks also announced a new product, Account Intelligence, which is powered by artificial intelligence. It lets brands target customers within Spiceworks to market and advertise their products to. Its key features include a prioritized list of businesses currently in the market for a brand’s products and services, information on purchasing intent trends, and competitive insights. The product is currently being beta tested and is expected to be available early next year.

In addition, Spiceworks is using artificial intelligence to mine its data to provide its Spiceworks community members with more insights into market, business, technology and personal insights.

Spiceworks has always been transparent and upfront with its technology community about how it uses data, Hallberg said.

“Any data that is gathered and used has to be for the benefit of the user and not the brand,” Hallberg said.

Spiceworks is also General Data Protection and Regulation complaint. GDPR is a European Union law passed a few years ago to protect citizen’s data and privacy. The law is mandated for tech companies operating in Europe.

SpiceWorld also featured a keynote by Brian Krebs, journalist and Cybersecurity expert. Computer system breaches are the top concern of the Spiceworks community, Hallberg said.

Spiceworks also released its 2020 State of IT study examining technology budget shifts and emerging technology trends in organizations across North America and Europe. The report finds many businesses plan to update old computers to address growing security concerns.

For more, listen to the entire interview with Jay Hallberg. Also, please rate and review our Ideas to Invoices podcast on iTunes and support Silicon Hills News by becoming a patron on our Patreon site.